ECB raises its tone

In July, the ECB had already raised its rate on bank deposits from -0.5% to zero. After last Thursday's increase, the rate is now 0.75%... for an inflation rate of 9.1%.

Below, let's look at the evolution of inflation in the euro zone over the last 20 years:

Source: tradingeconomics - eurostat

This staggering and sustained rise is largely due to rising energy prices (which account for more than half of the price increase).

In Belgium, inflation has reached a record level to 9.94%, its highest level since March 1976, when it stood at 9.96%.

Inflation is defined as the ratio between the value of the consumer price index for a given month and the index for the same month in the previous year.

Inflation in the 1970s and 80s

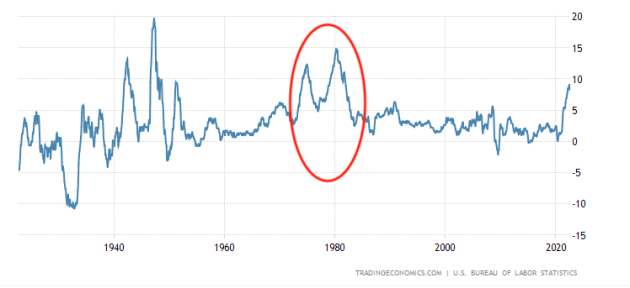

Let's take a step back and look at the situation in the United States during the previous inflationary period in the 1970s and 1980s.

In 1980, U.S. inflation peaked at 14.8% in March for an annual average of 13.5%. (https://www.usinflationcalculator.com/inflation/historical-inflation-rates/)

Inflation in the US:

Source: tradingeconomics - US Bureau of Labor Statistics

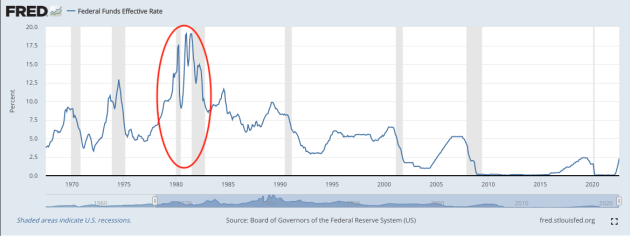

To counter this high inflation, the head of the U.S. Central Bank (Fed), Paul Volcker, raised rates to 19.1% in June 1981.

Fed interest rates:

Source: fred.stlouisfed.org

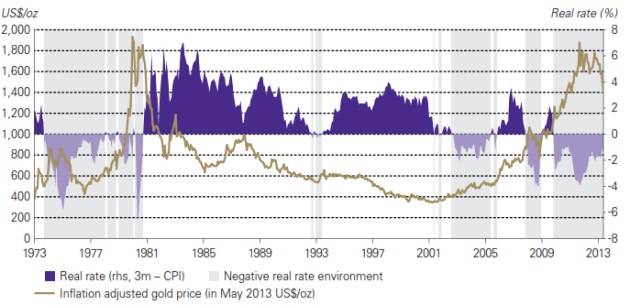

We can see that in order to counter it, interest rates must be higher than inflation. Below, we can see the evolution of real interest rates in the United States and the evolution of the price of gold in USD since the beginning of the 1970s and especially during the hyperinflationary period at the beginning of the 1980s.

Real rates are nominal interest rates minus inflation.

Source: gold.org

In the United States, with an average inflation of 10% in 1981 and a nominal interest rate of 19%, we obtain a positive real interest rate of 9% (19 -10 = 9). This period was unfavorable for the price of gold.

Gold and real interest rates traditionally have a negative correlation. The biggest booms in the gold market occurred in negative real interest rate environments, first in the 1970s, when nominal interest rates and inflation rates were high, and later in the 2000s, when nominal interest rates and inflation rates were low.

In Europe, currently, with a nominal interest rate of 0.75% and inflation at 9%, we are still with negative real rates of about 8.25%. There is still a long way to go and the ECB will have to raise rates much higher if it wants to counteract inflation, but the generalized level of indebtedness of the States seriously complicates the situation.

What about gold?

Despite the ECB's announcement, the yellow metal only dropped 1.6%. It is holding up well, as we can see below, but...

The central question is: "Will the ECB raise interest rates to levels above inflation in order to curb it like the FED did in the 1980s?".

The answer to this question is fundamental. In our humble opinion, we believe that the inflation induced by energy prices should subside over the next few months and that the level of government debt does not allow for too much monetary tightening at the risk of putting some Eurozone countries in trouble and accelerating the recession.

Gold prices in euros since the beginning of the year :

Source: tradingview

Since the beginning of 2022, the yellow metal has shown a gain of 5% in euros. It is currently trading around 1690 euros/ounce.

The situation is a little different for gold denominated in US dollars, given the Olympic form displayed by the greenback. Below we see that the yellow metal is in a more pronounced bearish channel due to interest rate noise.

Source: tradingview

It is currently trading around $1690 and is already working on a more important support level: the bottom of the consolidation box (red line), the July low and the 200 week moving average.

Over the last 20 years, it should be remembered that gold has achieved a performance of +440% in USD and +430% in Euro. This gives a compound annual return of around 8.6-8.8%. However, past performance is not a guide to future performance. The debate on interest rates is likely to disrupt the evolution of the gold price for some time to come, even if diversification remains an important investment rule. The behavior of USD and resistance or not of technical support will also be the main drivers in the coming days.

We remain confident in the long term in an environment of renewed volatility.

>>> Protect yourself now with physical investment gold stored outside the banking system!

The GFi team

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.