The collapse of the centralized trading platform FTX has triggered an earthquake in the crypto-currency world. While this doesn't call into question the technological promise and long-term utility of blockchain, reality reminds us that gold is currently the only safe haven to protect one's wealth over time.

Crypto-currency aficionados are used to comparing Bitcoin to gold. Thus, gold and bitcoin would each protect against the devaluation of paper currencies. Both would also protect against inflation and against a possible fall of the financial markets...

This view has been undermined if we compare the behavior of these two assets.

Indeed, the extreme volatility of bitcoin prevents it from being considered an effective safe haven. It gained 150% between January 2021 and its peak in November 2021, but it has fallen 70% since then and is currently trading lower than in early 2021.

Source: Tradingview

In contrast, gold gained 22% between January 2021 and its March 2022 peak. It has retraced 10% since that high, but is still up 10% since the beginning of 2021, and 6% in 2022 (in euros)... while it is in a sideways consolidation phase.

Source: Tradingview

Another important consideration is the dependence on technology. Unlike bitcoin, gold is a real asset that is not dependent on an internet connection or access to electricity.

In an extreme situation of war or blackout, access to the internet may be impossible.

Physical gold can be used even without electricity or internet connection. And it is naturally in times of acute crisis that the effectiveness of a safe haven asset is measured.

As far as the financial markets are concerned, we can see that gold is more reliable than bitcoin. Indeed, the S&P 500 index is down 15% in 2022. At the same time, bitcoin has lost 60% while gold has gained 6%.

With less volatility, gold remains a far more effective safe haven than cryptocurrencies, and any currency over the long term, for that matter.

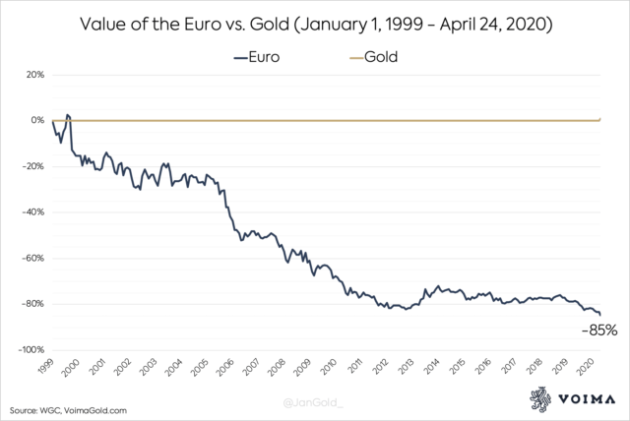

Since 1999, the euro has lost 85% of its value against gold (see chart below).

And ditto for the US dollar or even the Swiss franc, which have also lost value against gold since the turn of the millennium.

If bitcoin is initially designed to be a currency, it is mainly an instrument of speculation for the moment. Indeed, it is quite slow and expensive when you make transactions for small amounts.

We will see what will be left after the big bubble purge. Then maybe there will be some interesting things to do like after the internet bubble.

In the meantime, crypto-currencies may still be spiking, so take advantage of that if you know what you're doing. But in no way should bitcoin be compared to gold.

By the way, did you notice that bitcoin is always represented by a gold coin? The choice of this symbol is not insignificant and can be misleading.

Something to think about...

>>> Create your online account now and start saving in physical gold

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.