Gold started the year 2022 at 1608.9 euros/ounce and closed it at 1703.8 euros/ounce, an annual gain of 5.9%.

Geopolitical tensions

Between January and the beginning of March 2022, gold climbed +18% against the backdrop of the war in Ukraine. While the conflict seems to be "stabilizing", geopolitical tensions remain a hot spot to keep an eye on in 2023: relations between the West and Russia, but also China, among others.

On the chart below, we see that the yellow metal has entered a bearish channel for the rest of 2022 after its early March peak at 1901.76 euros/ounce.

Source: Tradingview

It retraced 13.3% to the October low at 1647.65 euros/ounce. The support zone held and gold bounced back afterwards. Since the beginning of 2023, it is breaking this bearish channel from above and is coming to work its resistance. Let's see if it confirms this breakout to prepare for a move back to the previous highs around 1850 euros/ounce and 1900 euros/ounce.

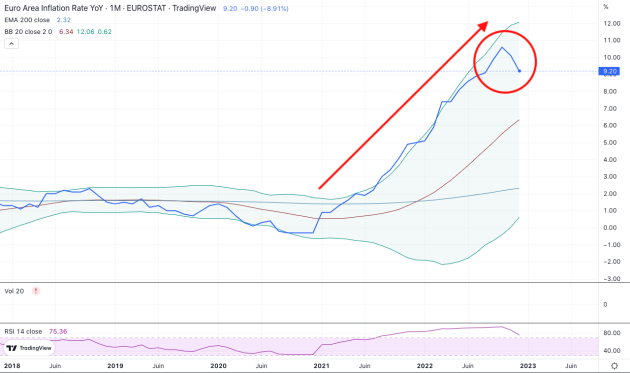

Inflation

Inflation in the Eurozone was already a hot topic in 2021 and it continued in 2022. It peaked at 10.6% in October only to slow to 9.2% year-on-year in December.

Source: Tradingview

Inflation will remain a crucial issue in 2023. It is hard to imagine a return to the 2% target without a truly significant increase in rates. But that could lead to a recession. So we are caught between a rock and a hard place.

And if the ECB had no other option than to lower rates again, it would generally be good for the yellow metal.

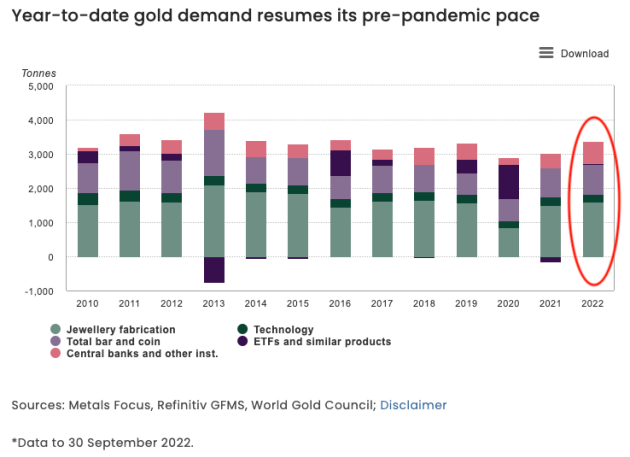

Central Banks

Gold purchases by central banks indicate the strategic importance of the yellow metal. In 2022, they bought more than 670 tons: an absolute record!

China alone has indicated a purchase of 32 tons of gold in November 2022. This is its first "official" purchase since 2019.

We can expect to see this trend of central banks continuing in 2023 to further diversify their reserves.

Note also that investment demand (coins and bullion) increased by +3% in 2022.

We do not have a crystal ball, but fundamentals and chart analysis indicate a nice bullish probability for 2023.

Indeed, even if we remain optimistic at GFI, the general economic context is likely to be tense again this year. Inflation will remain high, the energy issue is not resolved and will probably still have cascading consequences.

>>> Be prepared now and accumulate physical gold!

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.