American stagflation in the 1970s

This is the only episode of stagflation in the United States in recent history.

In the 1970s, inflation exploded in successive waves to peak at 13% in 1979.

In 1973, the oil exporting countries reduced their production in the context of the Yom Kippur War. This tightening of supply led to the first oil shock, which caused high inflation and increased unemployment.

In 1979, a second oil shock worsened the situation and marked the end of a period of high production growth for Western countries.

The average annual price of oil rose from $2.70/barrel in 1973 to $35.52/barrel in 1980!

As a result, global economic growth was hit hard. And the unemployment rate rose from 3.5% in 1969 to 9.7% in 1982.

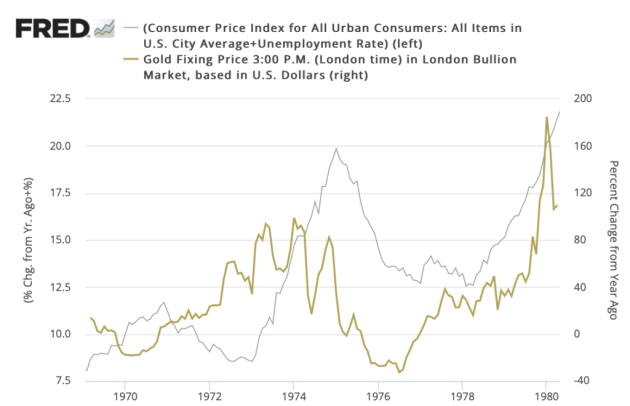

At the same time, the price of gold jumped between 1970 and 1980 from $36/ounce to $692/ounce, a gain of 1800%!

Today, the risk is once again very real.

Economist and former U.S. Treasury Secretary Larry Summers stated in March 2022 in the Washington Post that the U.S. could experience stagflation or even a recession.

He is not alone. In addition to the World Bank, other major institutions, such as Goldman Sachs and BlackRock, have also warned of the risks of stagflation.

What about the Euro Area?

According to Eurostat, the unemployment rate in the eurozone was 6.5 percent in November 2022, stable compared to the previous month.

But the unemployment rate for young people (under 25) stood at 15.1% in both the EU and the eurozone, up from 15% in both areas in the previous month.

With unemployment at historically low levels, countries are facing recruitment pressures.

Eurozone growth was 0.3% in Q3 2022. Societe Generale forecasts growth of 0.8% in the eurozone in 2023.

If inflation slows down, it will remain high in 2023.

For Belfius Research, it is mainly the weakness of consumption that will weigh on growth in 2023 in Belgium. High inflation is eating away at the purchasing power of households, and the automatic indexation of wages does not offer everyone sufficient protection against the rising cost of living.

The sharp rise in energy costs and wage costs for companies will lead to a slowdown in economic activity. Profitability is under pressure, so that many companies are forced to reduce production.

With low growth and high inflation, the risk of stagflation in the Eurozone is also very real.

Favouring the yellow metal?

If stagflation takes hold, this could be beneficial to the yellow metal as a diversification tool and a hedge against risk.

Investors tend to favor gold in times of uncertainty.

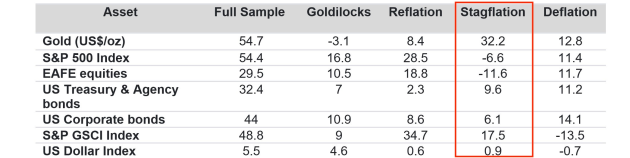

The table below shows the average annual adjusted return since Q1 1973 (in %) based on quarterly returns.

Source: Bloomberg, World Gold Council

We can see that gold is the best performing asset in times of stagflation.

In the chart below, we can observe the relationship between the change in the price of gold in dollars (in %) and the US consumer price index for all urban consumers.

Source: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, ICE Benchmark Administration

For the moment, the yellow metal is doing well. It has even risen since the beginning of 2023, with a gain of 3.5% in euros and 4.4% in dollars for a third consecutive month of increase.

In the current context, gold remains an indispensable asset in a balanced long-term portfolio.

>>> Create your account online and start accumulating gold now!

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.