|

Hello,

Very quick summary for long term investors: Nothing is happening!

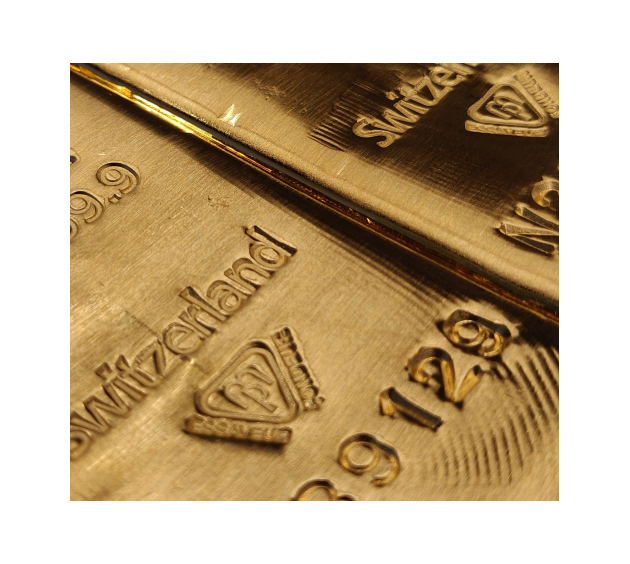

The yellow metal gained +0,67% to close at 1508 €/once.

|

|

|

We see on the chart above that gold has been drifting sideways for almost eight months in a range roughly between 1400 € and 1600 €.

The gray metal lost -2,69% to close at 20,1 €/once.

|

|

|

|

On the chart, we see that it has broken the ascending triangle from below (blue lines) and for the moment, like gold, it remains in a lateral drift within a range roughly between €23.5 and €18.5.

So, no clear direction while the inflationary environment should drive them higher.

So, this week, you may have seen some doom and gloom articles that predict the end of gold.

I mentioned this in the previous email.

On Monday, August 9, we saw a "flash crash" (a very rapid decline) in gold and silver between midnight and 1am (Paris time).

This corresponds to the opening of the Asian markets.

We could say that this is a continuation of the drop on Friday August 6 after the announcement of a positive report on the employment figures in the United States.

Well, we have to temper these numbers a bit, because creating jobs that were cut just before is not really creating jobs and the labor shortage continues to be felt.

July 2021 Jobs Report: Employers Add 943,000 to Payrolls

Then, if we look at this "flash crash" a little closer, we notice something.

Basically, someone sold $4 billion worth of gold (in futures contracts) at the opening of the Asian markets (a time when the market is very light, as Europeans and Americans are not in the markets or are very light at that time).

This is a completely disproportionate move, even given the announcement of possible monetary tightening by the US Federal Reserve.

Gold Flash Crashes By Almost $100 As $4 Billion In Sell Orders Hit

In fact, many large institutional investors need to get out of their short positions (a downside bet) before gold and silver prices resume their upward climb. (The Basel III accords are moving in that direction).

He may be a big investor who holds even bigger short positions than the 4 billion that were let go, which allowed him to make a profit "by losing 4 billion"... And why not to buy back cheaper right after.

In short, this is a clear case of price manipulation.

And you don't have to be a conspiracy theorist to recognize this, because the mainstream press is now talking about it openly.

But then, all this happened on the futures market.

A futures contract allows you to buy an asset at a future date and at a price fixed in advance.

For example: the price of a gold future for September 2021 is $1778.

|

|

|

|

If I am a jeweler and I am planning my production for September, I plan to buy X kilos of gold that month, but I would like to protect myself against a possible change in price. So I buy the amount I need in futures contracts and I am sure I will be able to buy the gold I need in September, because the price will be fixed. Whether the price of gold goes up or down, I will buy it at $1778/ounce.

This principle of futures contracts can be found on all commodities.

This is also true for the farmer who wants to fix the price of his future crop.

It is a market that serves as a basic insurance.

Today, it is a speculative market.

Observing the price evolution of these contracts allows us to see how the markets anticipate the price of raw materials.

So if a malicious actor wants to manipulate the prices of a market, he will act on the futures.

Manipulation du marché de l'or ?! (voir la vidéo de la chaîne Grand Angle)

For the long-term physical investor, this makes no difference.

If this type of trading can still continue despite obvious conflicts of interest, you just need to own physical and accumulate more on these price drops.

Thus, you are giving them a judo grip by using their strength to your advantage.

These short-term price manipulations do not change the increase in the money supply by central banks, the loss of purchasing power of paper currencies, the mountain of debt that weighs on the global financial system.

Everything that underpins a long-term strategy.

And the Basel III rules are going to make manipulation more complicated, because you will have to have 100% physical coverage of the positions you hold.

No more buying and selling paper gold with no physical behind it. And this is bullish for the price of precious metals.

Moreover, the price already does not reflect exactly the real price set by supply and demand, because we see for example a 30% premium on the purchase of investment silver coins. The price is 20 € and you pay 26 € for your coin. |

|

|

In short, this mini-crash is just a blip in a long bull market, which has resumed in 2019 after a nearly 10-year correction.

80% of a bullish move happens in the last 10% of the time.

They will do everything they can to scare you into letting go of the bar. Never lose sight of the horizon.

This could be the calm before the storm.

And in the end, only gold will remain! |

|

|

Have a nice week,

Vincent from

www.goldconsulting.be

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.