As we enter the new year of 2022, it is time to take a quick look back at the year 2021 that has just ended. How have gold and silver performed this year? The situation remains tense, especially in terms of inflation, and it is best to keep an eye on precious metals.

The yellow metal is in the green

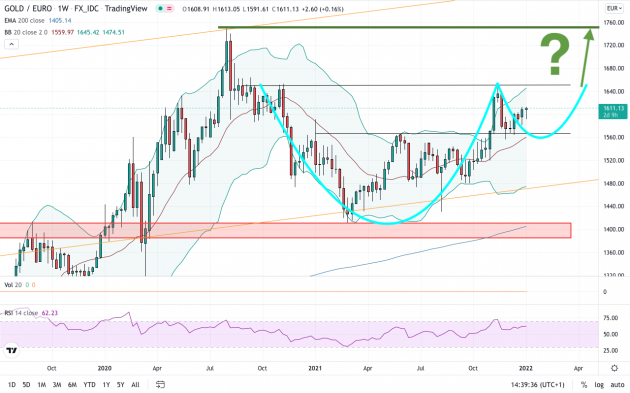

Gold opened the year 2021 at €1553.73 and closed at €1608.53.

This gives an annual performance of +3,53% to celebrate the 20th anniversary of the euro, which was officially launched on 1 January 2002.

On the price side, the yellow metal is still in its sideways range that started in August 2020, between €1650 and €1410 or so, but it has still offered us some action by testing the bottom and top of the range during the year.

Source: Spot Price Tradingview

Indeed, it touched the support zone at the end of February - beginning of March before rebounding to mark an intermediate resistance in the range around €1565 at the beginning of June.

An intermediate resistance that it retested and broke in November before going for the resistance at the top of the range at €1650.

It then corrected, but the former resistance around €1565 became a support that it worked at the end of November - beginning of December, with a small scare the week of November 29 with a low at €1556.

The support held, gold rebounded and closed the year in positive territory.

The yellow metal's action over the year continued the formation of this cup and loop chart pattern (in light blue), a trend continuation signal, bullish in this case.

Coupled with the resistance that has become support (also a bullish signal), gold could put a smile on our faces in 2022.

Of course, these are neither predictions nor investment advice, just probabilities, avenues for reflection that we can illustrate with the inflation chart.

Source: statbel.fgov.be

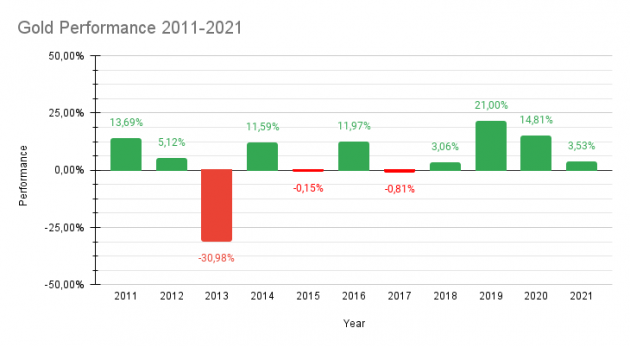

As a bonus, here is the performance of the yellow metal over the last eleven years between 2011 and 2021.

It is interesting to note that gold was in consolidation between 2012 and 2020. Despite this, it has only had three years in the red (including the serious correction in 2013) and the average performance remains +4.8%.

Gold confirms once again that it is a robust and stable long-term asset. What can it offer us if it starts a new upward leg in 2022?

Silver is in a bad way

The grey metal opened 2021 at €21.53 and closed at €20.47, a yearly performance of -4,94%.

On the price side, silver is still in its box, its lateral range started in August 2020.

Unlike gold, which is already showing more strength, silver has not yet broken any major resistance and is much closer to the 200-period moving average, which is an important support indicator.

Instead, the grey metal chose to break down a nice ascending triangle that it had been preparing for us since June 2020.

It even retreated to the bottom of the range where it re-tested an important support zone in late September around €18.5.

As we know, silver is much more volatile than gold. You have to be able to withstand this higher volatility.

Support held and silver bounced back to intermediate resistance just above €23 in mid-November.

Again, it corrects, but without falling back to support. No, it prefers to bounce at €19 rather than €18.5.

Is it preparing a second ascending triangle?

For the moment, it is working the middle of the Bollinger bands and continuing its consolidation phase.

We are keeping a very close eye on silver in 2022!

Also as a bonus, here is the performance of silver metal between 2011 and 2021.

Unlike gold, it has only had four out of eleven years in the green.

But this gives an average positive performance of +0.6% with seven years of consolidation.

See you soon to follow the evolution of the prices of our two precious metals.