A masterful move by Russia?

On Wednesday, March 9, Russian President Vladimir Putin signed a law abolishing VAT on private gold purchases.

In mid-March, the Russian central bank suspended its gold purchases from the country's banks to meet increased demand from the public.

On Friday, March 25, the Russian central bank announced that it would resume gold purchases from banks at a fixed price of 5,000 rubles per gram from March 28 to June 30.

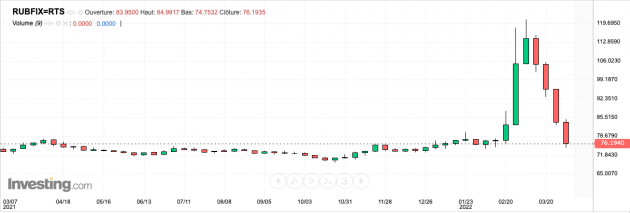

As a result, the ruble strengthened by about 20% after this announcement, dropping from 100 to 80 to the US dollar.

Why? Because the price of gold is about $60/gram. At 5,000 rubles/gram, that's 80.6 rubles to the dollar.

In fact, the Russian currency has now recovered its entire loss against the U.S. dollar.

Source: Investing.com

An article picked up by ZeroHedge on April 4 gives us some details:

By buying gold at a fixed price, the Russian central bank is backing the ruble against the yellow metal while setting a floor price for the ruble against the dollar since gold is traded in US dollars.

Now, if the West tries to use the paper gold market to drive down the dollar price of the yellow metal via Comex and the LBMA, they will have to drive down the ruble as well, otherwise everyone will see the manipulation.

In addition, Vladimir Putin has been forcing "unfriendly" countries (USA, EU, UK, Japan, Australia) to buy Russian gas in rubles since April 1.

Source: Reuters

This could further strengthen the ruble and, as a result, also push up the price of gold.

In short, gold, Russian natural gas and the ruble are all three linked together now.

And Russia could do the same thing with oil. If Russia starts demanding payment for its oil exports in rubles, there will immediately be an indirect link to gold (via the ruble-gold fixed price connection).

Russia could also start accepting gold directly as payment for its oil exports.

In fact, this can apply to all commodities, not just oil and natural gas.

What consequences for the price of gold?

By linking the ruble to gold and then linking energy payments to the ruble, Russia is turning the global monetary system on its head.

If Russia starts accepting gold directly for oil, a new mass of buyers will start looking for physical gold and this could blow up the LBMA and COMEX paper gold markets that price gold via unallocated synthetic gold and derivatives (basically, gold that doesn't really exist).

If a majority of international players begin to accept paying for commodities in rubles, it could propel the Russian ruble to the status of a major global currency.

According to Alasdair Macleod, a precious metals market analyst, Russia and China together own about 32,000 tons of gold, 12,000 for Russia and 20,000 for China respectively.

That's far more than the United States.

Is this true or not? It's hard to say, but we can assume that both countries own more than they officially declare.

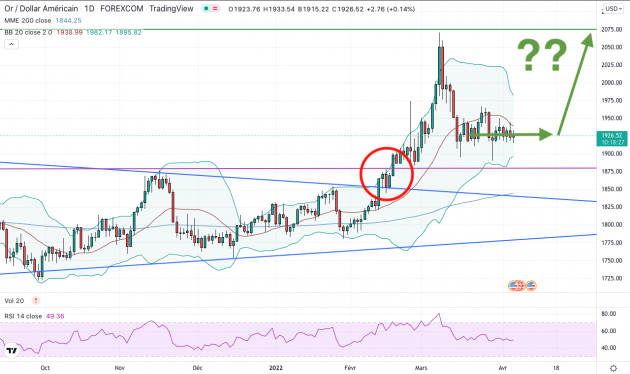

For now, gold is holding up well despite the "rate hikes" and is drifting sideways in the short term.

Source: Tradingview

The yellow metal is digesting its 10% rise of February-March.

The Bollinger bands are tightening, the RSI is at 50. This indicates a possible consensus on the current price.

Let's see how gold handles this mini-consolidation and how it intends to come and retest the resistance around $2070.

And if it decides to retest the support around $1880.

Conclusion

For the moment, Russia has not re-established a gold standard as such, but the trend towards de-dollarization of the non-Western world is accelerating.

Although Reuters reported on Thursday, April 7, that due to a "significant change in market conditions," Russia's central bank would buy gold from commercial banks at a negotiated price starting April 8, not a fixed price of 5,000 rubles per gram.

Anyway, in the context of the "paper currency war", the yellow metal is the only real currency and its role will grow stronger.

Indeed, history teaches us that all paper currencies eventually disappear.

If the non-Western world turns away from the euro/dollar, these currencies will lose their importance and value.

The West represents 950 million people out of the 8 billion or so on the planet, or just 12% of the world population.

We are entering a period of great uncertainty in which the United States and the dollar are losing their global leadership.

Will the ruble or the yuan become the new reserve currencies backed by gold?

It is impossible to predict exactly what will happen next, but we can be sure that the world is experiencing the beginnings of major tectonic shifts.

We are experiencing a real paradigm shift.

Under these conditions, physical gold will most certainly play its full role as a safe-haven asset in a strategy of diversification and protection of purchasing power.

>>> Protect your purchasing power now!

The GFi Team

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.