A great pattern in US dollars

The yellow metal closed the week at $1898 with a gain of +1.75%.

The week of February 7, 2022, it had broken above this long 18-month consolidation triangle and closed the week above it.

The week of February 14, 2022, gold confirmed this breakout by testing the $1900 per ounce mark.

Indeed, it did not fall back into the triangle. It did retest the breakout, but it quickly moved back up to close at $1898, above the pivot around $1877 (purple line).

Source: tradingview

Of course, chart analysis does not predict the future, but it does offer us probabilities.

Clearly bullish, in this case.

We hope to see gold go for its previous high at $2075.

Now, it is better to see the yellow metal climb quietly by working the various intermediate resistances at $1900-1915, $1960-1965...

And of course, the symbolic resistance of $2000.

If it starts sprinting too fast and too hard, there will be profit taking.

It will run out of steam faster and therefore there will be consolidations.

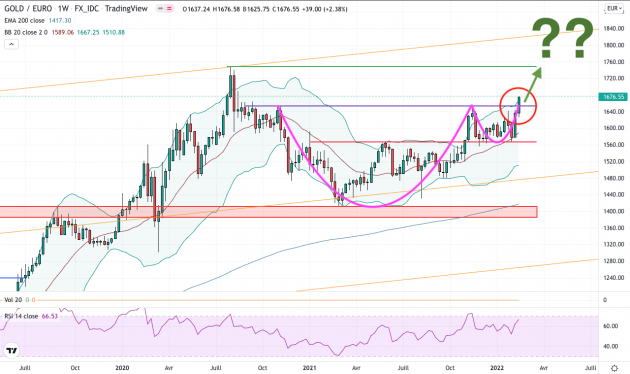

The chart of gold in euros? Not bad either!

The underlying trend is the same.

If the king chart is that of gold expressed in U.S. dollars, we must also observe the price in the currency we live with: the euro.

The yellow metal closed the week at €1676.5 for a gain of +2.38%.

Source: tradingview

We also see an upward breakout, but of a cup and handle pattern (pink line) instead of a triangle.

The cup and handle is a trend continuation pattern.

So the signal is also bullish, and that makes sense.

And here we are waiting for chart confirmation with a close above the pivot price around €1655 (purple line).

Then, the yellow metal can go for its previous peak of August 2020 at €1749 before perhaps offering us new highs.

The context is therefore tense, good for gold

In addition to the chart analysis, several elements play in favor of an appreciation of the yellow metal.

So, very briefly...

Inflation is high, notably because of the increase in the price of energy products (gas, electricity, fuel...). Inflation was 7.59% at the end of January, compared to 5.71% in December and 5.64% in November (source: statbel.fgov.be)

Real interest rates are negative. And this is starting to be widely accepted and understood by a majority of savers and investors.

(Read our article: New record: 300 billion euros on savings accounts!)

This impacts government bonds, which are supposed to protect against portfolio volatility. At the end of February 2021, 63% of government bonds in the euro zone were giving a negative return. (source: test-achats.be)

The situation in Ukraine. It is difficult to separate the wheat from the chaff in the media propaganda. Is the US itself creating the tension it denounces? Does Russia really embrace the project of invading Ukraine? It is difficult to know. But one thing is certain: geopolitical tensions are usually good for the price of gold.

Stock markets are consolidating to digest the significant rise since March 2020 (+120%). They could drift sideways with a volatility of +/- 15% over the year 2022.

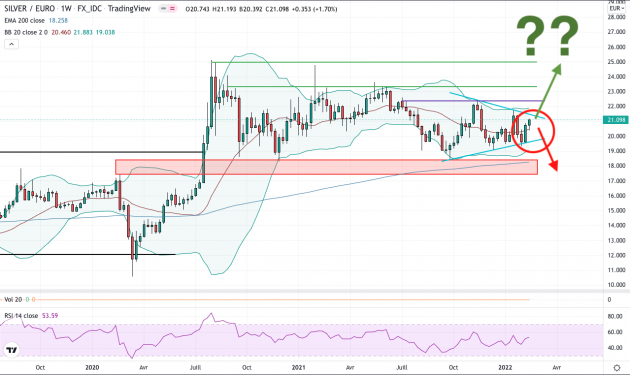

A quick look at silver

Silver closed the week of February 14, 2022 at €21 for a weekly gain of +1.70%.

Source: tradingview

On the chart, we see that silver, like gold, has been in a consolidation range, a box in which it is drifting sideways, since August 2020.

The underlying trends between gold and silver are mostly in the same direction.

On the other hand, silver tends to start late, relative to gold.

But beware, when it does wake up, the volatility is greater.

Unlike gold, silver is currently moving at the bottom of its channel.

We also see a pivot on the gray metal between 22 € and 22.5 €.

While gold is already breaking its pivot, silver still needs to work on its pivot for buyers to accept the idea of accumulating above this price.

With the RSI at 54 and a consolidation triangle where volatility is tightening as well as the Bollinger Bands, chart analysis is whispering more and more clearly that this consensus moment is approaching.

Conclusion

Gold has been in consolidation for 18 months and is beginning to break out of it.

Silver will probably follow.

Stock market indices seem to be entering a consolidation, and could become bearish.

If volatility increases, it is better to stay in cash and take a position in gold. And possibly silver in the near future for a larger potential gain.

So, it's true...

We can feel a bit lost when we have to restructure our portfolio after following a strategy for 10 or 15 years.

However, there is no need to panic or, worse, to sit back and do nothing.

Gold is becoming relevant again in the eyes of a growing number of investors as portfolio insurance and also as a speculative tool to position oneself at the start of an uptrend that could last several months, quarters or even years.

Let's hear it...

The GFI team

PS: To buy/sell and store gold safely and without moving, create an account on our GFI Gold platform. It's quick and easy.

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.