The Fed raises rates, so what?

On March 16, the U.S. Central Bank (the Federal Reserve or the Fed) announced a rate hike of 0.25% to 0.50%.

Source: CNBC

The news caused quite a stir.

This is its first rate hike since December 2018 and it plans six more in 2022.

Incidentally, the Fed revised its growth forecast downward and its inflation forecast upward.

In short, this is it! After claiming that inflation was a mirage, then only a temporary problem, the Fed is finally admitting the seriousness of the situation and taking action.

Yes, except that...

Inflation in the US was officially at 7.9% in February 2022.

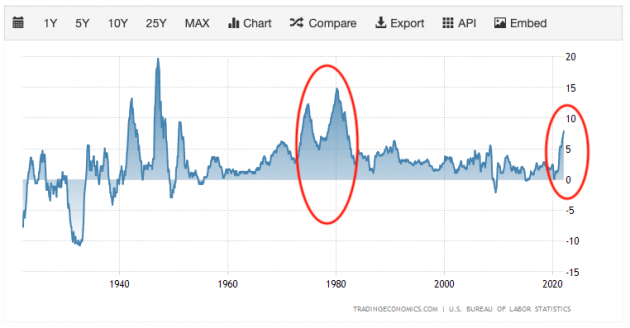

Let's compare below with the situation in the 1970s.

Source: Inflation USA - Trading Economics

We see that inflation peaked at 15% in 1980.

To stop it, Paul Volcker, the Fed's director at the time, raised rates to 20% in 1981.

Indeed, for this to work, rates must be higher than inflation.

Now let's compare the inflation graph above with the US interest rate graph below.

Source: Fed Funds Rate USA - Trading Economics

We can see right away that a rate of 0.50% will not be able to stop inflation at 8%.

So, isn't this news finally "much ado about nothing"?

Now, the Fed is probably planning to raise rates as they go along... until they get stuck.

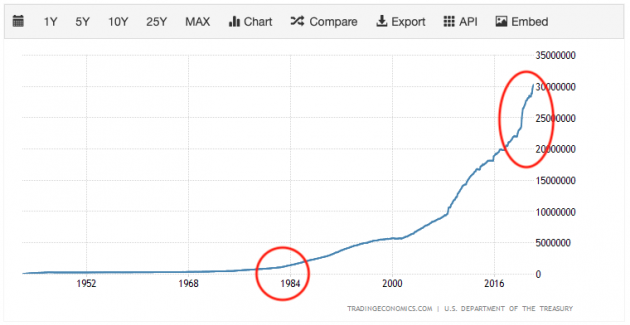

Because, unlike in the 1970s, the debt is likely to be a problem and make it impossible to raise rates significantly.

Below is a graph of the US public debt: $908 billion in 1980 versus $30,000 billion in 2022, or +3,200%.

Source: US National Debt - Trading Economics

Raising interest rates will further increase the burden of an already astronomical debt.

The problem is also that markets are now addicted to accommodative monetary policies.

All of these factors indicate that inflation is likely to get worse and last longer.

Central banks are caught between a rock and a hard place.

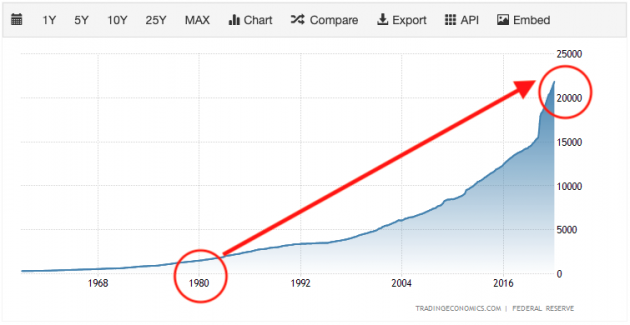

Another big difference from the inflation of the 1970s? The money supply M2 has grown from $1.6 trillion in 1981 to $21.8 trillion in 2022, or +1260%.

Source: M2 - FRED - Federal Reserve Bank of St. Louis

And history teaches us that money creation always leads to inflation.

« Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. » - Milton Friedman

How did gold react?

For some analysts, there is generally a negative correlation between gold and interest rates.

This is because when rates rise, it is usually a sign of a strong economy, which gives investors the confidence to buy stocks and bonds.

Despite some negative correlation in the 2000s, gold and interest rates have also risen together quite often.

For others, higher interest rates are theoretically supposed to make stocks less attractive, as higher rates mean higher borrowing costs for businesses and consumers, which reduces overall spending.

In any case, markets like gold reacted rather positively.

Both fell immediately after the announcement before rebounding quickly.

In the end, the S&P500 closed the day up 2.2% and gold up 0.48%.

On the chart of gold in USD, the yellow metal made a low at $1895 on the day of the Fed announcement.

Since then, volatility has been tightening around 1930 and it is drawing a short-term consolidation triangle, also with a pivot/resistance at 1950, which is joined by the average of the Bollinger Bands (see chart below of the price of an ounce in $).

Source: Tradingview

In the short term, the yellow metal could fall and retest the old pivot turned support at $1880, or even the old consolidation triangle around $1840 which is then joined by the 200-day moving average.

When it has finished working this consolidation, gold will probably continue to form this handle by going back to work the resistance at $2075.

To see more clearly the formation of this cup and handle pattern, we refer you to the chart in our March 10, 2022 analysis.

Conclusion

We are probably only at the beginning of a very important inflationary phase, or even of stagflation (high inflation with low growth). Especially since inflation is driven by energy prices, which are likely to remain high for a long time.

Central banks must act without jeopardizing the entire monetary and financial system, but for the time being, the markets seem to ignore this (until when?).

If inflation continues to rise, it is better to diversify one's assets and also own gold to hedge against a loss in value of the currency.

See you soon!

The GFI team

--

Disclaimer:

The data presented on this page is provided for information purposes only and does not constitute investment advice, an offer to sell or a solicitation to buy, and should not be relied upon as a basis for/or inducement to engage in any investment.

Past performance is not constant over time and is not indicative of future performance. This newsletter does not take into account your financial situation and objectives. The investor is the sole judge of the appropriateness of the transactions he/she may enter into.

The information on this website is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For more information about Gold and Forex International: see the Terms and Conditions.